The term "crypto," according to Merriam-Webster, refers to “a person who secretly supports or adheres to a group, party, or belief.” Dictionary.com echoes this definition, highlighting the clandestine nature of the affiliation.

In today's digital landscape, the word "crypto" has taken on a new and intriguing meaning. Kaspersky, the global computer security software company, defines cryptocurrency as “a digital or virtual currency that uses cryptographic techniques to secure transactions. It exists solely in electronic form, operating independently of any central authority and relying on decentralized networks, such as blockchain technology.”

Cryptocurrency is digital cash secured by cryptography. It’s purely virtual, existing only online, and operates independently of central banks on decentralized networks like blockchain. In essence, it's a digital payment system that bypasses traditional banks, facilitating peer-to-peer transactions. These transactions are recorded in a public ledger, with cryptocurrencies stored in digital wallets.

But why is it called "crypto"? The term derives from the use of encryption to verify transactions. This sophisticated coding process secures data between online “wallets” and the “public ledger”, ensuring the integrity and safety of the transactions.

Many people are under the wrong idea that crypto is a means of moving money without evidence or a paper trail therein giving it an avenue for crime and corruption to rule the roost. Nothing can actually be farther from the truth. This misunderstanding is now coming to find the truth that blockchain technology is a means to have digital transactions immediately, affordable, and fully traceable. This is something that our current system of cloud based transactions cannot match. For those who remember the fax machine, I look at it this way. A fax mirrors what today’s primary cloud based financial transaction process is, which is called Swift. Consider Swift to be the fax machine to the internet and a pdf file. And blockchain technology is the platform that is the combination of both old concepts into today’s new digital technological platform. In the future, as we add quantum computing into the blockchain technology we will experience possibilities that we cannot even comprehend today.

To understand the backdrop against which cryptocurrency emerged, consider the historical context. In 1971, President Richard Nixon took the United States off the gold standard, ending the direct convertibility of dollars to gold. This move transformed the dollar into a "fiat" currency, backed not by a tangible asset but by the government's assurance.

Fast forward to September 10, 2001, when Secretary of Defense Donald Rumsfeld announced that the Department of Defense could not account for over $2 trillion. The following day, the tragic events of 9/11 unfolded, including the mysterious collapse of Tower #7, which housed financial records related to Rumsfeld's announcement.

In 2008, the bankruptcy of Lehman Brothers marked the climax of what the media tabled as “the subprime mortgage crisis”. This event triggered a financial panic, leading to massive government interventions amounting to Trillions of dollars in order to stabilize the economy. The crisis exposed the fragility of the financial system and the true limitations of government control or care to control.

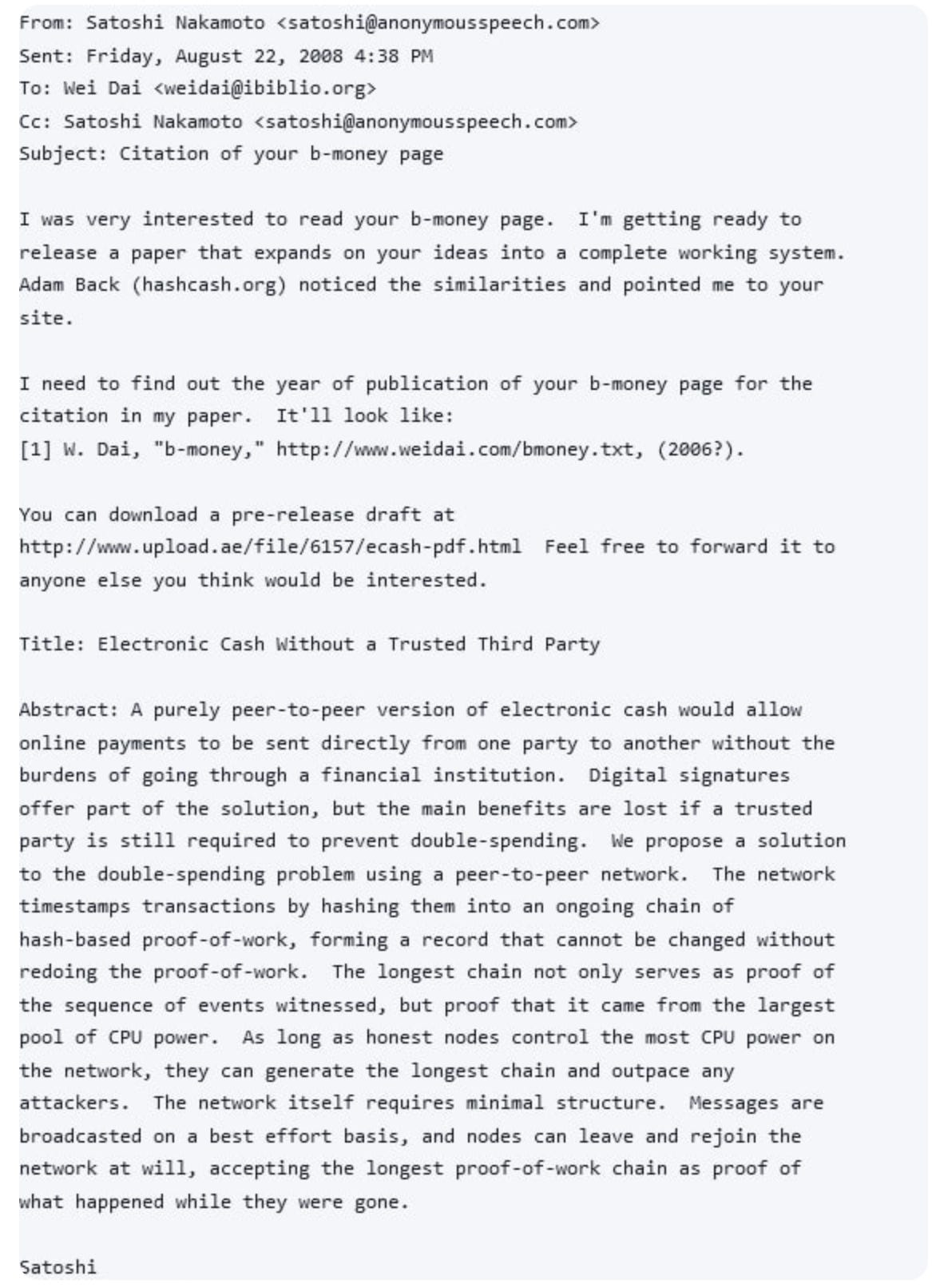

Amidst this turmoil, the domain name bitcoin.org was registered on August 18, 2008. On January 3, 2009, the Bitcoin network was born when its mysterious creator, Satoshi Nakamoto, mined the “genesis block”. This block in the blockchain used contained a message referencing the financial instability of the time, symbolizing Bitcoin's origins as a response to the systemic failures of traditional finance.

So, how does cryptocurrency work? It revolves around blockchain technology, a public ledger that records all transactions. New cryptocurrency units are created through mining, a process that involves solving complex mathematical problems with computational power. Cryptocurrencies can also be bought from brokers and stored in digital wallets.

Owning cryptocurrency doesn't mean holding something physical. Instead, you possess a key that allows you to transfer a unit of measure from one person to another without intermediaries. Despite Bitcoin's introduction in 2009, cryptocurrency and blockchain technology are still evolving. The potential applications extend beyond currency, with possibilities for transactions involving bonds, stocks, and more.

There are thousands of cryptocurrencies, but here are a few notable ones:

- **Bitcoin (BTC)**: The pioneer and still the most popular, created by Satoshi Nakamoto.

- **Ethereum (ETH)**: A platform with its own cryptocurrency, Ether, launched in 2015.

- **Litecoin (LTC)**: Similar to Bitcoin but with faster transaction speeds and innovations.

- **Ripple (XRP)**: A ledger system used for various transactions, backed by numerous financial institutions.

- **Tether (USDT)**: A stablecoin pegged to the US dollar, offering stability in the volatile crypto market.

- **Binance Coin (BNB)**: The native token of the Binance exchange, used for reduced fees and various purposes within the Binance ecosystem.

- **Solana (SOL)**: Known for its high transaction speeds and low fees, utilizing proof-of-history and proof-of-stake mechanisms.

- **US Dollar Coin (USDC)**: Another stablecoin pegged to the US dollar, fully backed by dollar reserves.

- **Dogecoin (DOGE)**: Originated as a meme but gained popularity for its low price and endorsements from celebrities.

- **Cardano (ADA)**: A third-generation blockchain platform focusing on scalability and sustainability with a proof-of-stake mechanism.

Cryptocurrency is undeniably here to stay. Its evolution and increasing integration into the financial system signal a shift in how we perceive and utilize money. However, the journey hasn't been without controversy. In July 2019, then-President Trump criticized Bitcoin and other cryptocurrencies, labeling them as "unregulated crypto assets" that could facilitate unlawful activities. His comments were partly fueled by concerns over Facebook's planned Libra cryptocurrency, which raised significant regulatory questions.

Despite initial skepticism, the political landscape around cryptocurrency is evolving. There are over 100 countries throughout the world that are using the crypto currency platform to move the financial products between them at an exponential rate. At the Bitcoin2024 conference, which began today and is being held in Nashville, the presence of prominent figures like former crypto denier President Trump and various politicians underscores the growing recognition of cryptocurrency's political and economic significance.

The conference reflects the increasing political engagement with cryptocurrency, highlighting its potential to reshape financial systems and regulatory frameworks. As the dialogue continues, the intersection of technology, finance, and politics will shape the future of cryptocurrency.

If you're intrigued by blockchain technology or investing in cryptocurrency, I'd love to hear from you. What draws you to this technology? What investments are you considering and why? Let's delve into this transformative world together.