Preamble -

Douglas J Boggs:

“I’ve titled this “Judges and an impartial court.

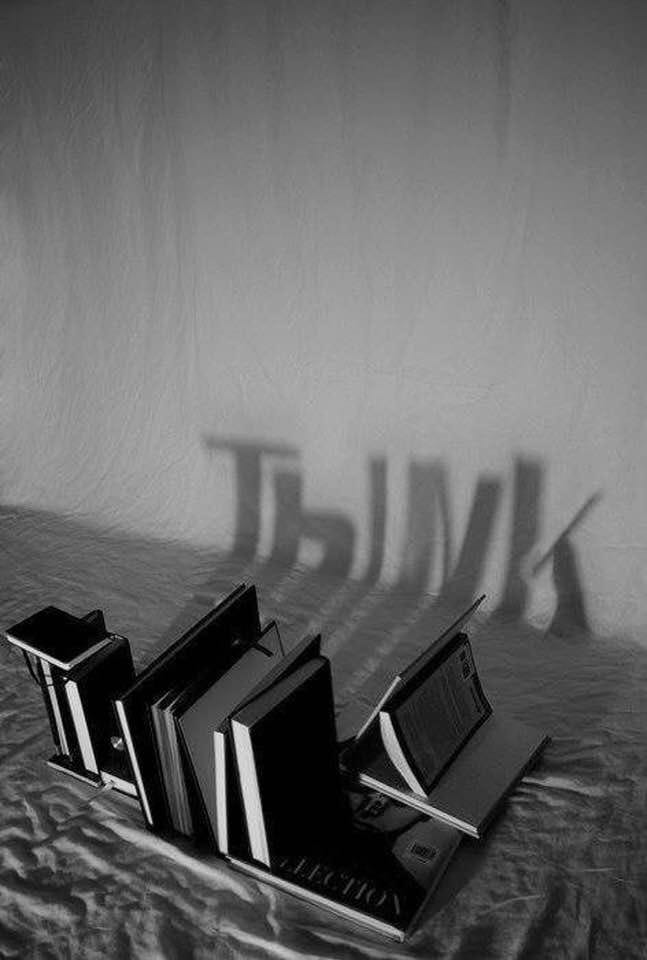

Hello again and welcome to “Smoke and Mirrors…the art of critical thinking” and my podcast “Re-Framing the World with Douglas J Boggs” Today is January 18, 2023 and I want to thank you all for tuning in.

I think this show is going to be quite interesting. My guest today is attorney Scott Stafne, of Stafne Law Advocacy and Consulting, based out of Washington State. We will be getting into his most recent filing with the United States Supreme Court and his arguments about judicial neutrality. This is something we see as a concern even as high as the United States Supreme Court with some of its controversial justices, most recent being Justice Clarence Thomas and his wife's association with the January 6, 2021 insurrection at the United States Capital. But, before we get into that I wanted to set a bit of the stage, so to speak.

My book, Quantum of Justice, which many of my listeners are familiar with, and if you are not you can find it here on my blog to purchase, they know it stems from a lawsuit for fraud, against Wells Fargo Bank, which I acted as my own attorney and litigated myself. The basic premise of the lawsuit, and what I cover in the book, is about the judicial neutrality or the independent nature of a trustee in a deed of trust relationship in a non-judicial foreclosure. I discuss how there is a systemic judicial failure if this independence no longer exists. There is standing law from the CA Supreme Court’s decision in 1978 in Garfield v Contra Costa County the court stated that ,“There are three parties to a deed of trust agreement and that being the beneficiary, the Trustor and the Trustee.” They went on to state, “They are to be held at arms length from the Beneficiary and the Trustor in the deed of trust agreement.” The Trustee is therefore to be deemed an independent party to the deed of trust agreement. Their independence is crucial in this relationship because the trustee is tasked to act on behalf of the court. Through the Trustee’s independence lies the impartiality of the trustee to oversee the deed of trust agreement and its actions of the parties in the agreement and the actions and remedies of the Power of Sale clause in a deed of trust in the state of CA. This is outlined as California Civil Code 2924 et al.

Through this impartiality and the independence there is a presumption of correctness in all of the documentation and decisions that are made by the Trustee because they are acting on behalf of the court. Their independence is what makes their position of the decision maker in a non-judicial foreclosure action. Due to the independent nature of the Trustee, it is their task to review and over view all of the documents, actions and reactions of all of the parties involved in the deed of trust agreement and to make sure that all parties are acting in accordance to the rule of the power of sale clause in the deed of trust agreement and the non-judicial foreclosure procedure. It is called non-judicial because the trustee is tasked to act on behalf of the court. They are taking the place of a judge, hence the term non-judicial.

The initial idea of this process was to minimize real estate litigation that the legislators felt were clogging the courts. By taking the real estate transactions out of the mortgage litigation and into a non-judicial platform, therein freeing up some of the court’s docket and including an independent trustee, the courts felt confident, due to the independence of the relationship of the trustee in the deed of trust, to act impartially on behalf of the court.

Now, what I exposed and explained clearly and effectively to the court and subsequently showed in my book, Quantum of Justice, was that in 1996, the CA legislature amended a code of the power of sale clause, code 2934a. In Senate Bill 1638 the Senate was creating a way to help expedite the substitution of a trustee. Since the bill had gone through its series of discussions and meetings and its wording was getting honed and ironed out it had reached a level of unanimous consent in the state senate and was going to be approved. There were two lobbyist lawyers who had been tasked to help to construct the bill. These lawyers belonged to the Mortgage Brokers Association and were signed on to help solidify the legislation. The night before the vote was heading to the Senate floor, where the bill had gone through its various incantations and arguments to a point of finding it to be a unanimous decision, evidence shows that these two attorneys allegedly came in at the last hour and rewrote some of the wording of the bill. Since it was a bill that had already gone through the processes of review not one on the Senate floor re-reviewed the final writing of the bill that was ultimately submitted and voted on. Unanimously.

It then became new law, the new wording to the CA Power of Sale clause was forever changed and all was forgotten about. That is until I got it and reviewed it. I petitioned the state for the file of the formulation of this bill. I wanted to fully understand what had transpired. During my lawsuit I found out that this change had taken place and that the new wording allowed the beneficiary to file fraudulent paperwork to the court without any recourse since there was no longer any independent oversight to the deed of trust process.

You see, the wording to the bill, as it was decided and codified now allowed the bank, the beneficiary in a deed of trust, to substitute the trustee as needed. The bank held the power to replace the trustee at their will. In other words, if a trustee of record would not allow a beneficiary to file certain documents against a homeowner in order to activate, or fulfill any rules the financial institution or any party acting on behalf of the institution were supposed to follow as was outlined in the Power of Sale clause in a deed of trust, the trustee could be removed and substituted. This means that the trustee no longer holds power to protect any property owner in CA against wrongdoing from the beneficiary or any other party against the title of the property owner. The trustee was now owned by the bank. There was no longer independence to the trustee in a deed of trust as was outlined and decided law by the CA Supreme Court back in 1978. When the Supreme Court ruled that the Trustee must be held at arms length. However, all of that changed in 1996 which became an active code change beginning in Jan 1, 1998. They could no longer be referred to as an independent party in a deed of trust agreement if the beneficiary, a party to the agreement, was able to substitute the trustee at their sole discretion.

What I outlined and explained to the court was that if there was no independence to the trustee in a deed of trust agreement, as the CA Supreme Court had decided, then the actual deed of trust contract agreement was void on its face. That is unless the financial institution had made a point of explaining all of this to the property owner at the time of the purchase of the property in order to help them facilitate their decision to sign the purchase agreement. If the bank had explained to the prospective buyer that as soon as they sign the purchase agreement and the deed of trust they now hold absolutely no right to their title to the property from that point forward and that the bank or any party acting on behalf of the bank could then file fraudulent documents with the court with no recourse allowing them to foreclose on the property owner at any time whether they were current on their payments, paid off the property or even if a property owner had paid cash, they could now find themselves being foreclosed on. Now, since the trustee holds the presumption of correctness in the filings of all of the documents pertaining to any foreclosure proceeding, since they are acting on behalf as the court, it is therefore assumed by any other court that all of the documents filed by the trustee have been deemed correct. This shrewd move has allowed decades of property transactions, and millions of documents filed to the court, to be done so fraudulently.

Needless to say this opened up pandora’s box with the state of California which is why they silenced my paperwork, removed the entire four years of 117 filings in the docket from the public accessible court records and quickly dismissed my case on a technicality. From there I took it to the Appellate division of the court. When I was writing my filing for the Appellate court I asked the court for the transcripts of all of the case records through my entire case so that I could include some of this for the public record in my Appellate Brief. The court stalled for the longest time as my timeline to write the Appellate Brief was winding down. Then at the last minute they informed me that they could not find any of the court reported documentation that pertained to my case. None. Everything was missing. This reduced my evidentiary material that I could include, some of which, was quite damning evidence against Wells Fargo. You can imagine what ruling then subsequently transpired. So, when I went to the CA State Supreme Court, they quickly found minute clerical issues that they used to dismiss my case from ever seeing more light of day.

So, I put it all in a book.

When people hear all of this they tend to hone in on two words. Wells Fargo. They neglect to see the forest for the trees. This pertains to any lender, any law firm acting on behalf of any lender, any trustee in a deed of trust. This is systemic corruption with a domino effect valued into the trillions of dollars, just in the state of CA. Now, I also understand that the state of Washington is a deed of trust state, Where my guest today, Scott Stafne, runs a law firm which focuses a lot on foreclosure law. There are 34 states that use the deed of trust. If you sit quietly enough and wrap your mind around this, this is one of the greatest frauds ever perpetrated against the American public. The value is well into the trillions of dollars.

Now, before I get to you, Scott, and taking it just a bit further, all of these notes are then securitized on Wall Street. All of the fraudulent mortgage documents are securitized on Wall Street. Just that alone should give someone pause as to the levity of this house of cards. However, after my lawsuit, I became a trained and nationally certified forensic loan securitization auditor and I found that absolutely every case that I have conducted or reviewed were filled with fraud during the securitization process. So, not only the documents that are being securitized are based solely on fraud and by law should be considered void, the securitization process on Wall Street was ripe with fraud as well. The value of the securitization market in the United States, as of 2021, is over $12 Trillion. This does not take into account the Collateralized Debt Obligations of those Mortgage Backed Securities that investors are investing in. All of it is based on fraud.

The courts don’t listen. They don’t pay attention. It has become quite difficult to use a Forensic Loan Securitization Audit in a court today. It exposes too much. It pulls back the curtains. Many of the judges in the courts, nationwide, have large portions of their retirement portfolios in the financial sector. This was shown and explained in my book as well. I am friends with many attorneys across the country who have been disbarred or their careers have been destroyed when they have exposed this. Many judges, across the country, have been found to be getting kickbacks on the foreclosed properties they are litigating. I have had some conversations with a few retired judges who were willing to discuss this. I have a few who have said that they will come forward on record to discuss this as this has affected tens of millions of families. For decades.

Ok, enough preamble.

Now, when I was preparing for this interview with my guest, attorney Scott Stafne, of Stafne Law Advocacy & Consulting, I found a bit of similarity to my case, and much of the information that I put in my book, and to your most recent filing you have to the Supreme Court of the United States.

We’ve known each other for a little while now. We came across each other online years ago, while I was writing my book. We found that we both grew up and come from the same region of this great country that being from eastern Iowa. After finishing my writing of, Quantum of Justice, I asked you if you would review it. Which you did, thank you very much. I always enjoy our phone discussions on various parts of the rule of law and I appreciate your passion to truth and justice for all.

Now, I want to talk about your PETITION FOR WRIT OF CERTIORARI, or Writ of Cert for short for those cool kids who are in the legal world... Your petition for writ of cert on the Larson v Snohomish County, et al. which is a case you are signed on to as Council of Record that you filed to the United States Supreme Court. For those looking this information up it is Case No. 100619-5 for the Washington State Supreme Court and a link to the PDF of the Petition can be found here in my blog. I found a lot of similarity to this case and the request and to what I have been screaming from the mountain tops for over a decade and part of the reason why I wrote my book. The similarities are that, a judge in the court of law and a trustee in a deed of trust in a non-judicial foreclosure hold the same position. That is to be an impartial party to the situation. A judge is supposed to be impartial. Neutral. A judge is to act as an impartial mediator to an argument. Through that impartiality, a judge is then supposed to make their decisions as it is applied to the rule of law.

Scott, can you please explain what a Writ of Certiorari is and what you are trying to accomplish with the United States Supreme Court in this case?”

Q and A continues…

To purchase an author signed hardcopy of my acclaimed book “Quantum of Justice” CLICK HERE

Share this post