South Korea's significant interest in XRP can be attributed to a combination of cultural, economic, and market-specific factors. Here's a breakdown of the key reasons:

1. Tech-Savvy Population and Crypto Enthusiasm

South Korea has a highly tech-savvy population with a strong appetite for innovation, making it a fertile ground for cryptocurrency adoption. XRP, being one of the most prominent cryptocurrencies, has naturally gained traction in this environment.

The country has a vibrant crypto community, with active participation in trading, meetups, and forums, which fosters interest in digital assets like XRP.

2. Regulatory Clarity

South Korea has implemented a stringent but clear regulatory framework for cryptocurrencies. This has provided legitimacy and confidence to investors, encouraging them to trade and invest in digital assets like XRP.

The government’s proactive approach to regulating the crypto sector has created a safer and more transparent trading environment.

3. XRP's Utility and Popularity

XRP is known for its fast transaction speeds and low fees, making it an attractive option for both retail and institutional investors.

Ripple's partnerships with financial institutions and its focus on cross-border payments resonate with South Korea's interest in innovative financial technologies.

4. Market Dynamics and Speculation

South Korean traders are known for their speculative trading behavior, often driving significant price movements in the crypto market. XRP's volatility and potential for high returns make it a popular choice for such traders.

Political and economic instability, such as the recent impeachment crisis and martial law declaration, has led to increased interest in cryptocurrencies as a hedge against the falling value of the South Korean Won.

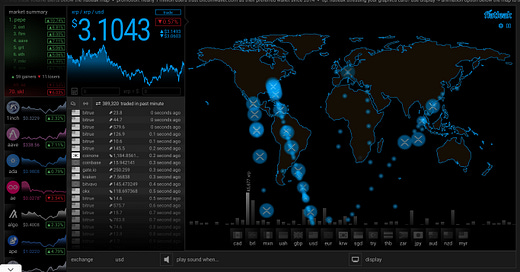

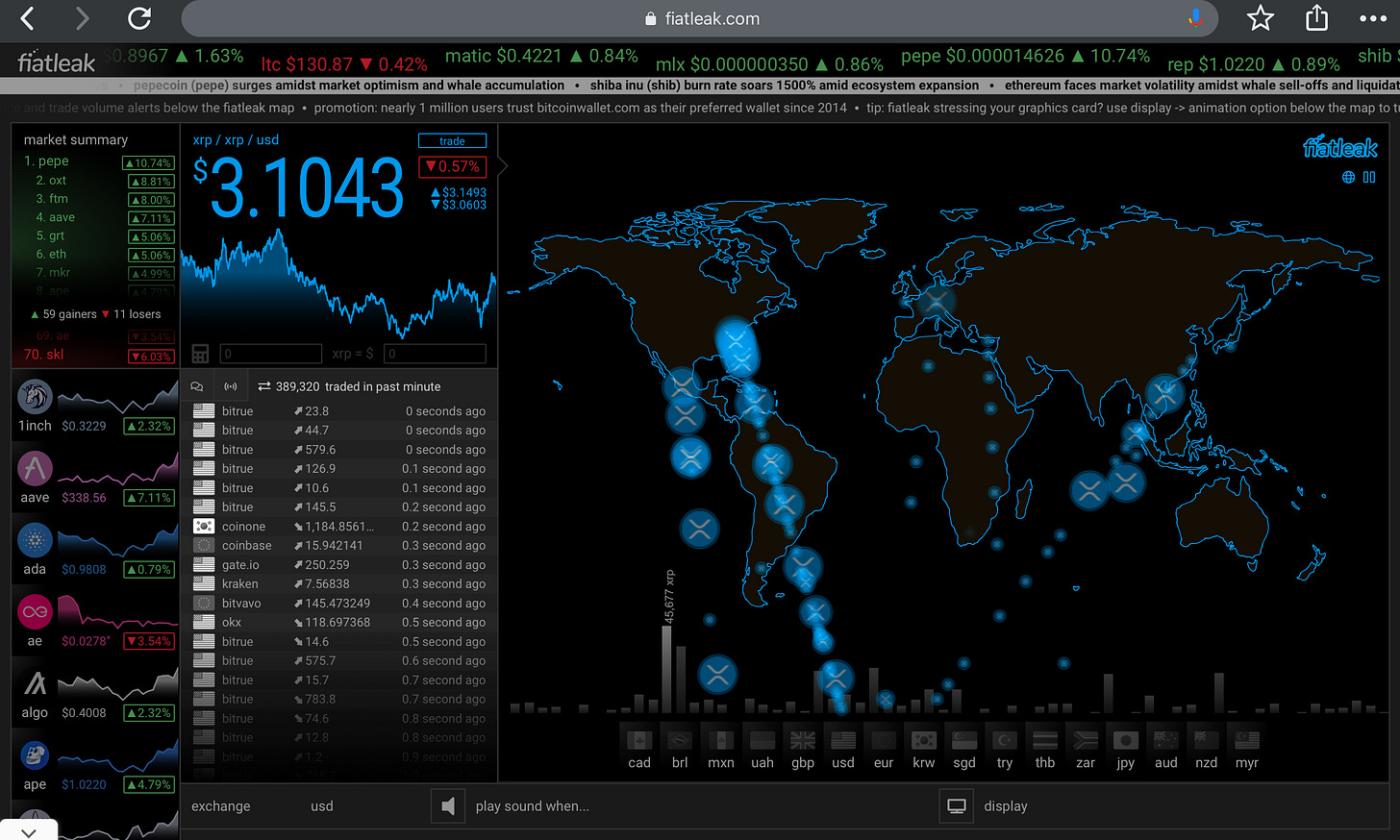

5. High Trading Volumes and Exchange Activity

South Korea consistently ranks as one of the top sources of XRP trading volume globally. Exchanges like Upbit and Bithumb report massive XRP trading activity, often surpassing Bitcoin and Ethereum in volume.

The prevalence of mobile trading apps and user-friendly platforms has made it easier for South Koreans to trade XRP.

6. Cultural and Economic Factors

The "Kimchi Premium," a phenomenon where cryptocurrencies are often priced higher on South Korean exchanges compared to global markets, has historically driven trading activity. While this premium has fluctuated, it reflects the strong local demand for crypto assets like XRP.

Economic challenges, such as a weakening won and low interest rates, have pushed investors toward alternative assets, including cryptocurrencies.

7. Arbitrage Opportunities

During periods of market volatility, South Korean traders have capitalized on arbitrage opportunities, buying XRP at lower prices locally and selling it on international exchanges for profit.

8. Community and Marketing Efforts

Ripple has actively engaged with the South Korean market, fostering partnerships and promoting XRP's use cases. This has helped build a strong community of XRP supporters in the country.

South Korea's strong interest in XRP is driven by a mix of technological enthusiasm, favorable regulatory conditions, economic factors, and the token's unique features. The combination of these elements has positioned South Korea as a major hub for XRP trading and adoption.