The story of Ripple, the XRP Ledger (XRPL), and the XRP token is a tale of ambition, reinvention, and relentless pursuit of legitimacy in the ever-shifting landscape of digital finance. As Ripple emerges from its bruising legal battle with the SEC, the company has set its sights on a new frontier: becoming a federally chartered bank, launching a regulated stablecoin (RLUSD), and doubling down on compliance and institutional partnerships. Yet, beneath the surface of these bold moves, existential questions about the future of XRP—and its place among ISO 20022-compliant digital assets—linger unresolved.

With the SEC’s lawsuit finally receding in the rearview mirror, Ripple CEO Brad Garlinghouse is operating with renewed vigor. On July 2, Ripple announced its application for a federal bank charter with the Office of the Comptroller of the Currency (OCC), aiming to become only the second crypto-native entity after Anchorage Digital to secure such a distinction. Simultaneously, its custody partner, Standard Custody and Trust Company, is seeking a coveted Fed master account to directly hold deposits that back RLUSD at the Federal Reserve. Just as I have been touting for a few years now, and my wife can attest, that Ripple is destined to become the global central bank and XRP is the digital currency that will drive capitalism.

This dual-pronged regulatory strategy—combining state oversight via NYDFS and federal oversight via the OCC—signals Ripple’s intent to set a new benchmark for trust and compliance in the stablecoin market. The company is rapidly building out RLUSD’s infrastructure, forging partnerships with Switzerland’s AMINA Bank and London’s OpenPayd to create a global payments network.

The XRP Paradox: Price Defiance Amid Stagnant Utility

Despite these headline-grabbing developments, the core question remains: what is the future of XRP itself? The token, still primarily owned by Ripple Labs, has seen a 347% price surge since November 2024 and is rumored to be on the cusp of its first spot ETF in the U.S.—yet its price has been largely stagnant for six months. This paradox is rooted in the persistent disconnect between XRP’s market capitalization and its real-world usage.

XRPL’s on-chain activity remains underwhelming. In 2023, the ledger earned just $583,000 in fees, and even after doubling in 2024, total fees barely exceeded $1.15 million. With a market cap that ballooned to over $113 billion, this translates to a staggering price-to-sales ratio of over 100,000—an order of magnitude higher than most “meme coins”.The XRPL’s decentralized exchange (DEX) rarely exceeds $100,000 in daily volume, paling in comparison to competitors like PancakeSwap, which routinely handles over $1 billion. NFT activity is similarly anemic, with only about 550 daily traders compared to Ethereum’s 5,000.

The absence of native smart contracts has further constrained XRPL’s utility, though the recent launch of an EVM-compatible sidechain with Axelar—where XRP serves as the gas token—could open new avenues for demand. Still, real, non-speculative usage remains elusive, and the company faces an uphill battle to convert this technological upgrade into meaningful adoption.

Ripple’s pivot to stablecoins, embodied by RLUSD, is both a response to market realities and a potential existential threat to XRP’s original value proposition. XRP was conceived as a bridge asset for cross-border payments, but the explosive growth of stablecoins—now a $255 billion market—has shifted the narrative. Stablecoins like Tether and USDC are not only dominating trading volumes but are also being integrated into payment and DeFi ecosystems at a rapid pace.

The introduction of RLUSD raises the specter of cannibalization: if RLUSD succeeds, it could erode demand for XRP as a bridge currency, especially given stablecoins’ lower volatility and regulatory clarity. Even Ripple CTO David Schwartz acknowledges the need for “multiple paths” to serve customers, conceding that XRP’s addressable market is likely smaller than it was a decade ago.

There is, however, a strategic logic to Ripple’s stablecoin move. The regulatory “scarlet letter” attached to XRP post-SEC litigation made many banks and institutions wary of direct exposure to the token. RLUSD, with its regulatory pedigree and direct Fed backing (if the master account is approved), offers a more palatable onramp for institutional adoption.

Yet, the stablecoin market is anything but a blue ocean. Tether and Circle have entrenched positions, deep liquidity, and powerful partnerships (e.g., USDC’s integration with Coinbase and Shopify). For RLUSD to carve out a meaningful niche, Ripple will need to leverage its war chest—over $10 billion in XRP holdings and $83 billion in escrow—to aggressively incentivize usage, bootstrap partnerships, and perhaps drive value back to XRP via its EVM sidechain.

If Ripple has one unassailable advantage, it is its capital reserves. The company’s XRP holdings make it arguably the best-capitalized crypto firm in the world. This financial firepower gives Ripple the runway to fund ecosystem development, subsidize adoption, and weather market downturns. Yet, this same advantage casts a long shadow: the prospect of billions in XRP being unlocked and potentially sold over time creates a persistent “sell wall” that could dampen price appreciation and unsettle holders.

ISO 20022 and the Digital Asset Interoperability Race

Ripple’s pursuit of ISO 20022 compliance and its banking ambitions place it at the center of the emerging digital asset interoperability race. The ISO 20022 messaging standard is rapidly becoming the backbone of global payments, promising richer data, enhanced transparency, and seamless integration between traditional finance and blockchain networks.

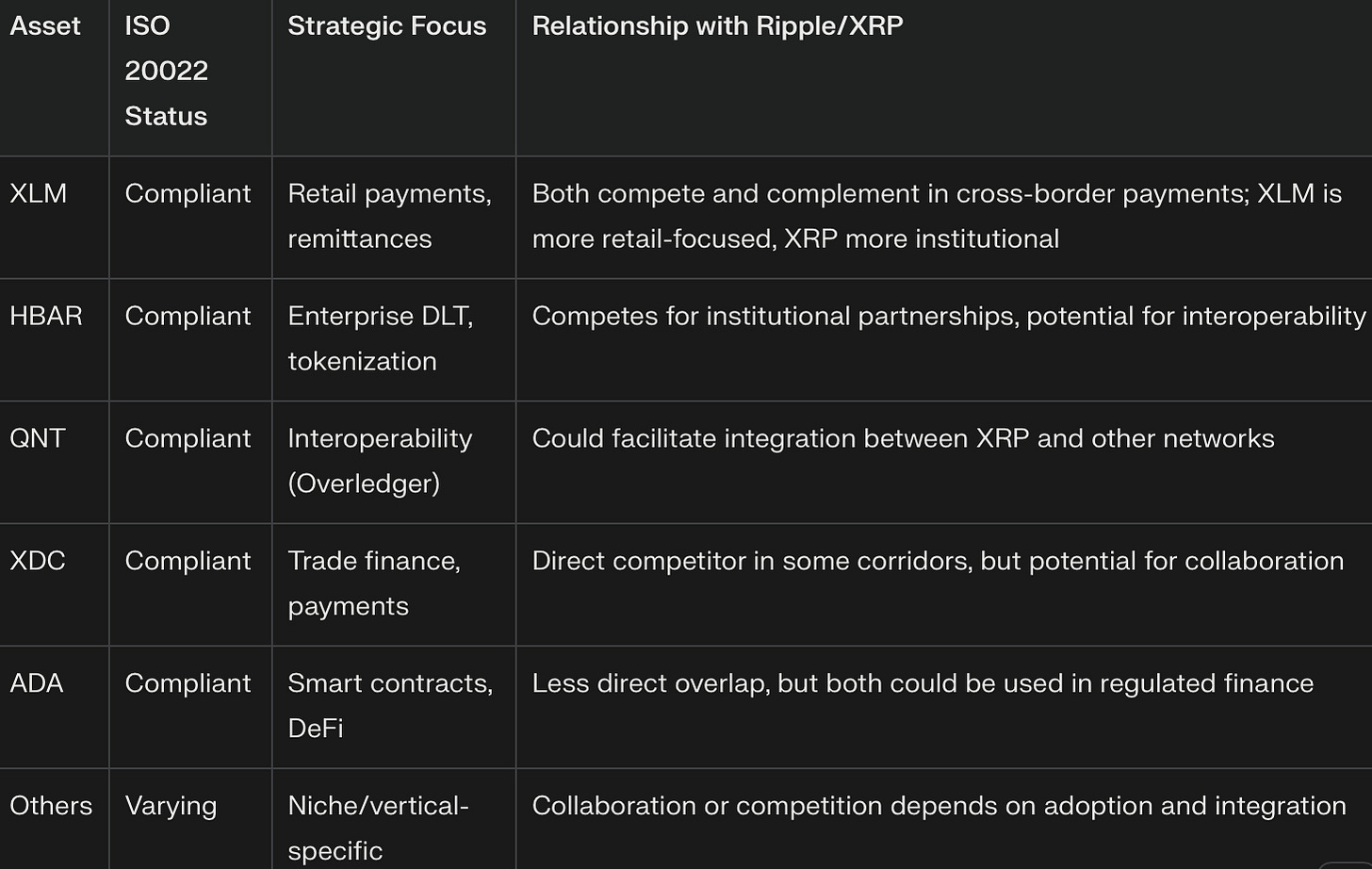

Ripple’s early and active participation in ISO 20022 standardization gives it a first-mover advantage, but it is far from alone. Other digital assets—XLM (Stellar), HBAR (Hedera), QNT (Quant), XDC (XinFin), ADA (Cardano), and more—are also ISO 20022-compliant or actively pursuing integration. Each brings distinct strengths, market focuses, and partnership networks.

The interplay between these networks is likely to be both collaborative and competitive. While ISO 20022 compliance enables interoperability and shared infrastructure, the battle for transaction volume, institutional partnerships, and regulatory acceptance will be fierce.

Ripple’s evolution from a payments disruptor to a would-be bank and stablecoin issuer is a testament to its resilience and adaptability. The company’s regulatory victories, banking ambitions, and capital reserves position it as a formidable player in the digital asset space.

AS XRP begins to transcend its current status as a “billion-dollar zombie,” as some critics have put it, Ripple delivers real, non-speculative utility—whether through its EVM sidechain, RLUSD integration, or new institutional use cases. The coming years will reveal that Ripple can leverage its advantages to finally unlock XRP’s long-promised potential.