I wanted to try a writing exercise with the Gladwellian approach to real estate investment. For those who know me know that I am a big fan of the best selling author Malcolm Gladwell. I have been a fan of his mind for decades. He is an inspiration to me as to how to look at things, how to step back and parse the evidence and look behind the curtains of truth. I am using this writing exercise to expound from my real estate experience and have a deep look inside the marketplace today as if it were from the mind of Malcolm Gladwell.

When I wrote “Quantum of Justice” I was inspired by his writing which forced me to rethink, review, and respond to the evidence that I was finding and how I was attempting to deliver it to the public at large. It is a definitive and special kind of art to take complex issues and deliver them in a way that people can understand.

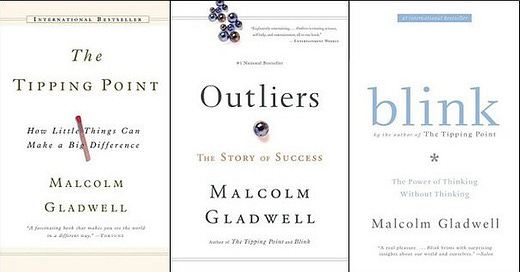

Malcolm is the acclaimed author of bestsellers like “David and Goliath”, "Outliers," "Blink," and "The Tipping Point," and he has a unique ability to take complex topics and make them accessible and engaging to a wide audience. In this essay, we will delve into real estate investment issues such as timing, location, risk perception, and value estimation as if from the perspective of Malcolm Gladwell, but by Douglas J Boggs.

Malcolm Gladwell often explores the fascinating intricacies of human decision-making and behavior. When applied to real estate investment, his keen insights shed light on the factors that influence investors' choices, successes, and failures. In this essay, we will explore the critical issues that shape the world of real estate investment.

Timing: The Power of the Tipping Point

In Gladwell's best seller "The Tipping Point" he teaches us that success often depends on identifying the right moment for action. In real estate investment, timing is crucial. Understanding market cycles, economic trends, and interest rate movements can mean the difference between a lucrative investment and a costly mistake.

Consider the 2008 housing market crash. Many investors bought properties at inflated prices just before the market collapsed. Gladwell's work on the tipping point suggests that they failed to recognize when the market had reached its tipping point, and a downturn was imminent. The lesson here is that successful real estate investors have an acute sense of timing, understanding when to buy, hold, or sell.

Location: The Magic of Place

In the book "Outliers" Malcolm emphasizes the significance of one's surroundings in determining success. In real estate, location is a paramount consideration. It's often said that the three most important factors in real estate are "location, location, location." As I was discussing in my previous article about the property in my hood that was just going on the market that had me interested, it is the worst house in the zip code and I like that.

A savvy real estate investor appreciates the power of place. They recognize that the value of a property can be greatly influenced by its proximity to amenities, schools, public transportation, and economic hubs. Malcolm's insights help us to understand that real estate investment success often hinges on choosing properties in areas with the potential for growth and development.

Risk Perception: Blinking at Opportunity

His book "Blink" explores the concept of rapid cognition, or the ability to make quick decisions based on instinct and experience. In real estate, risk perception plays a crucial role. Investors must assess the potential risks associated with a property, such as market volatility, neighborhood crime rates, or structural issues.

Successful investors develop an intuitive sense of risk, honed by years of experience and exposure to various situations. They can quickly assess a property's potential based on gut feeling, much like the "Blink" moments he describes in his book. However, it's crucial to balance this instinct with thorough research and analysis to make informed decisions.

Value Estimation: Thin-Slicing the Real Estate Market

Also in "Blink," he introduces the concept of "thin-slicing," which involves making accurate judgments based on a narrow slice of information. In real estate, value estimation relies on the ability to assess a property's worth quickly and accurately.

Real estate investors often encounter situations where they must decide whether a property is a good investment opportunity in a short amount of time. They must thin-slice the market, relying on their expertise and available data to make informed decisions about a property's potential for appreciation or rental income.

The Influence of Psychological Biases

What I so thoroughly enjoy about Gladwell's work is that he frequently explores the impact of cognitive biases on human decision-making. In the realm of real estate investment, these biases can significantly affect outcomes. Let's consider a few:

1. Confirmation Bias: Investors may seek information that confirms their preconceived notions about a property, leading them to overlook red flags or potential downsides.

2. Overconfidence Bias: Overestimating one's knowledge or ability to predict market movements can lead to risky investment decisions.

3. Loss Aversion: Fear of loss can lead investors to avoid opportunities that may have significant upside potential.

4. Anchoring: Investors may fixate on the purchase price or initial valuation of a property, making it difficult to adapt to changing market conditions.

Understanding and mitigating these biases is crucial for successful real estate investment.

The Power of Storytelling in Real Estate

Gladwell is known for his ability to convey complex ideas through compelling stories. In real estate, storytelling plays a significant role. The story of a property—its history, potential, and the vision of what it could become—can greatly influence its perceived value.

Consider a run-down, historic building in a neglected neighborhood. A skilled investor can craft a compelling narrative around the property's potential for revitalization, attracting both buyers and investors who are drawn to the story. Having a knack for storytelling reminds us that real estate isn't just about bricks and mortar; it's about the stories we tell about properties and their potential.

The 10,000-Hour Rule and Mastery in Real Estate

In his book "Outliers" Malcolm introduces the 10,000-hour rule, suggesting that it takes approximately 10,000 hours of practice to achieve mastery in a particular field. This concept applies to real estate investment, where expertise is a key factor in success.

Successful investors have often spent years honing their skills, learning from both successes and failures. They've put in the hours researching markets, analyzing deals, and building networks. This principle underscores the importance of continuous learning and dedication in the world of real estate investment.

Conclusion: The Gladwellian Approach to Real Estate Investment

In conclusion, we see that Malcolm Gladwell's insights into timing, location, risk perception, and value estimation offer valuable perspectives. Timing can make or break an investment, and understanding market cycles is akin to identifying tipping points. Location is the cornerstone of real estate, echoing the importance of surroundings highlighted in "Outliers." The rapid cognition explored in "Blink" can guide quick decisions and risk assessments. Thin-slicing the real estate market is a skill cultivated by successful investors.

Moreover, Gladwell's exploration of psychological biases reminds us to approach real estate investment with a critical and self-aware mindset. Recognizing and mitigating biases can prevent costly mistakes. Storytelling is a powerful tool in attracting investors and buyers to properties with potential.

Ultimately, real estate investment is a field that rewards expertise and dedication, echoing the principles of mastery outlined in "Outliers." Having a unique perspective, such as with Gladwell, it encourages us to approach real estate investment with a holistic understanding, combining data-driven analysis with the intuitive judgments that come from experience.

In the “Gladwellian approach to real estate investment”, success is not just about numbers and trends; it's about recognizing the human elements at play, from the stories that properties tell to the biases that shape our decisions. By embracing these insights, investors can navigate the complex world of real estate with a deeper understanding of the factors that drive success and failure.

You have been able in these few words to convey to me the importance of working with a realtor that you trust if you know you don't have the knowledge or experience to make good decisions about buying or selling your property. And it helps me know the best questions to ask them to be sure they do!