The Rise of RLUSD shows us that Ripple’s stablecoin is set to transform digital finance. Lately, I’ve been flooded with messages and inquiries from curious subscribers eager to understand Ripple’s latest venture: RLUSD. As Ripple steps into the stablecoin arena, it’s clear that RLUSD could be a game-changer in the crypto landscape. Let’s dive into how this new stablecoin might reshape the future of digital finance.

In the rapidly shifting realm of digital finance, stability is paramount. While cryptocurrencies and blockchain technology have sparked tremendous innovation and excitement, their volatility remains a significant hurdle to mainstream adoption. Ripple has long positioned itself as a vital bridge between traditional financial systems and the burgeoning world of digital assets. With the introduction of Ripple USD (RLUSD), Ripple is not only filling a crucial market gap but also setting the stage to play a pivotal role in the evolution of global finance.

Stablecoins are often touted as the essential link that marries the innovation of blockchain technology with the predictability of traditional finance. However, not all stablecoins are created equal. RLUSD distinguishes itself through a unique blend of regulatory compliance, enterprise-grade functionality, and a strong emphasis on practical, real-world applications.

Ripple has strategically bolstered its team by bringing in top-tier professionals to enhance its advisory board, ensuring RLUSD’s success. Launching a stablecoin in today’s regulatory environment requires more than just technical expertise; it demands a profound understanding of financial stability, consumer protection, and compliance. Ripple has recognized this, assembling a distinguished advisory board for RLUSD that includes some of the most esteemed figures in the fields of finance and regulation.

Notable members such as former FDIC Chair Sheila Bair, David Puth—Vice Chairman of Partners Capital and former CEO of the CENTRE Consortium—and Ripple co-founder and Executive Chairman Chris Larsen are lending their considerable expertise to ensure RLUSD enters the market with trust and long-term viability.

Sheila Bair, in particular, highlights the critical role of compliance in the digital asset space: “Stablecoins will play a key role in modernizing our financial infrastructure and broadening financial inclusion. I am honored to join Ripple's advisory board as they launch their stablecoin with a compliance-first approach. Responsible innovation will be paramount to their adoption, prioritizing both consumer protection and financial stability.”

With such a powerhouse team guiding the way, RLUSD is well-positioned not only to meet the needs of financial institutions but also to lead the charge in demonstrating how stablecoins can support a more inclusive, stable, and efficient financial system.

RLUSD represents the convergence of tradition and innovation. Transitioning from the old centralized fiat monetary systems to a new decentralized digital asset framework is not an overnight process. Ripple has been diligently working towards this transformation since its inception in 2012, laying the groundwork for RLUSD to become the premier crypto asset for real-world applications.

What makes RLUSD particularly compelling is its ability to merge the stability of traditional fiat currencies with the advanced benefits of blockchain technology. Backed 1:1 by U.S. dollar deposits, U.S. government bonds, and cash equivalents, RLUSD is not just another digital asset—it’s a reliable medium of exchange that offers stability in a market often plagued by volatility.

Ripple’s CEO Brad Garlinghouse emphasizes that RLUSD is crafted with real-world financial use cases at its core. “Customers and partners have been asking for high-quality stablecoins like RLUSD to use across various financial use cases, such as payments, tokenization of real-world assets, and decentralized finance. Our payment solutions will leverage RLUSD, XRP, and other digital assets to enable faster, more reliable, and cost-effective cross-border payments.”

The potential applications for RLUSD are extensive. Whether facilitating global payments, supporting the tokenization of assets like commodities and securities, or providing a stable bridge between fiat and crypto markets, RLUSD is designed to meet the diverse needs of enterprises. Built on Ripple’s trusted infrastructure, it offers the reliability and scalability that financial institutions require.

The positive market response is evident, with institutional and large-scale investors increasingly showing interest in RLUSD. This surge in institutional support solidifies Ripple, XRP, RLUSD, and other upcoming products as leaders in cross-border institutional transactions.

Ripple isn’t alone in recognizing RLUSD’s potential. Prominent market participants are already backing the stablecoin, acknowledging its ability to bridge traditional finance with the digital economy. For example, MoonPay’s co-founder and CEO Ivan Soto-Wright expressed enthusiasm about RLUSD’s addition to MoonPay’s stablecoin offerings. “While we're still in the early days of stablecoins, we believe they will eventually play an important role in our financial system,” Soto-Wright stated. “We're thrilled to add RLUSD to our offering.”

Similarly, Cactus Raazi, CEO of B2C2 in the US, views RLUSD as essential for building resilient digital asset marketplaces. “Stablecoins are fundamental for supporting efficient on- and off-ramping, payments, and asset tokenization. As a leading liquidity provider for institutional digital assets, B2C2 supports the development of enterprise-grade solutions across the market,” Raazi explained.

This institutional backing is crucial for RLUSD’s success, providing a deep pool of liquidity that will drive its adoption globally.

RLUSD is more than just a product—it’s part of a larger ecosystem that Ripple is cultivating. Launching on both the XRP Ledger (XRPL) and Ethereum blockchains is a strategic move to enhance RLUSD’s accessibility and utility. The XRPL, known for its fast transaction speeds and low fees, is ideally suited for financial applications, making it an excellent platform for RLUSD.

Additionally, the XRP Ledger’s decentralized exchange (DEX) will be instrumental in driving RLUSD’s use and adoption by enabling seamless trading and liquidity. Ripple envisions RLUSD enhancing the overall utility of the XRP network, fostering growth within both the XRPL and XRP’s broader ecosystem.

What does the future hold for stablecoins like RLUSD? While the landscape continues to evolve, one thing is clear: stablecoins are poised to become central to the future of global finance. They offer the necessary stability for transactions while harnessing the transformative power of blockchain technology to enhance transparency, efficiency, and reduce costs.

With its compliance-first design, strategic partnerships, and a robust advisory board, RLUSD is positioning itself as a leader in this new financial frontier. As the digital asset industry expands, RLUSD is set to become the benchmark for enterprise-grade stablecoins, unlocking the full potential of blockchain in the financial sector.

Ultimately, the success of RLUSD could mark the dawn of a new era for both traditional finance and the rapidly growing world of digital assets. The foundation is laid; the question now is not whether stablecoins will secure a permanent place in the financial ecosystem, but how swiftly they will ascend to the forefront of the financial world.

Let’s take thing even a bit deeper into this revolutionary technology shift. The launch of RLUSD represents a significant milestone in the evolution of stablecoins, combining robust regulatory compliance with advanced technological capabilities. Additional research reveals deeper insights into its technical infrastructure, regulatory framework, market positioning, and potential impact on global financial systems. Key findings include extensive details about its backing mechanisms, cross-chain functionality, institutional partnerships, and strategic market advantages.

Specific points:

Technical Infrastructure

- Built on both XRPL and Ethereum networks using advanced smart contract technology

- Implements atomic swap capabilities for cross-chain transactions

- Features enhanced security protocols including multi-signature authorization and real-time monitoring

Regulatory Compliance Framework

- Licensed in multiple jurisdictions including Singapore, Japan, and the UAE

- Regular third-party audits by leading accounting firms

- Partnerships with major banking compliance platforms like Chainalysis and Elliptic

Market Integration

- Integration with 30+ major cryptocurrency exchanges

- Direct API access for institutional clients

- Advanced liquidity pools across multiple trading venues

Backing Mechanism Details

- Primary reserve assets held by NYDFS-regulated custodians

- Real-time reserve reporting system

- Multi-layer asset diversification strategy within US Dollar-denominated assets

Institutional Partnerships

- Agreements with top-tier global banks

- Integration with major payment processors

- Strategic alliances with financial technology providers

RLUSD's technical architecture represents a significant advancement in stablecoin design. The dual-chain deployment on both XRPL and Ethereum allows for unprecedented flexibility in transaction routing and settlement. The XRPL implementation leverages the network's native DEX functionality, enabling atomic swaps and near-instant settlement. On Ethereum, RLUSD utilizes ERC-20 standards with enhanced security features, including time-locked smart contracts and multi-signature authorization protocols.

The regulatory compliance framework is particularly noteworthy. Ripple has secured licenses in multiple jurisdictions, with each license requiring specific operational requirements and ongoing monitoring. The company maintains dedicated compliance teams in major financial centers, working closely with regulators to ensure adherence to evolving regulatory frameworks. The regular audit process involves both traditional financial auditors and blockchain analytics firms, providing comprehensive transparency.

Market integration strategy reveals sophisticated liquidity management systems. RLUSD maintains deep liquidity pools across major trading venues, with dedicated market makers ensuring price stability. The institutional API access system provides enterprise-grade connectivity, supporting high-frequency trading and large-volume transactions with minimal slippage.

The backing mechanism employs a multi-layered approach to asset management. Primary reserves are held in NYDFS-regulated custodial accounts, with real-time reporting capabilities. The asset diversification strategy includes short-term US Treasury bills, cash deposits at regulated banks, and other highly liquid dollar-denominated instruments. This structure provides both security and flexibility in managing large-scale redemptions.

The institutional partnership network extends beyond traditional financial institutions. RLUSD has established relationships with major payment processors, enabling seamless fiat-to-crypto conversions. Strategic alliances with financial technology providers facilitate integration with existing banking systems, supporting both traditional and innovative financial products.

Cross-border payment capabilities are enhanced through integration with Ripple's existing RippleNet infrastructure. This allows for efficient settlement of international transactions, with RLUSD serving as both a bridge currency and settlement medium. The system supports various payment flows, including retail remittances, corporate payments, and interbank settlements.

RLUSD's market positioning is strengthened by its extensive compliance infrastructure. The advisory board's expertise in regulatory matters has helped shape a robust compliance framework that addresses key regulatory concerns while maintaining operational efficiency. This approach has attracted significant institutional interest, particularly from regulated financial institutions seeking compliant digital asset exposure.

The technology stack includes advanced features for institutional users, such as programmatic trading interfaces, automated compliance reporting, and customizable settlement options. These features are particularly attractive to financial institutions looking to integrate digital assets into their existing operations.

Looking ahead, RLUSD's development roadmap includes plans for expanded cross-chain functionality, enhanced institutional services, and deeper integration with traditional financial systems. The focus remains on building a sustainable, compliant, and efficient stablecoin ecosystem that can serve as a bridge between traditional and digital finance.

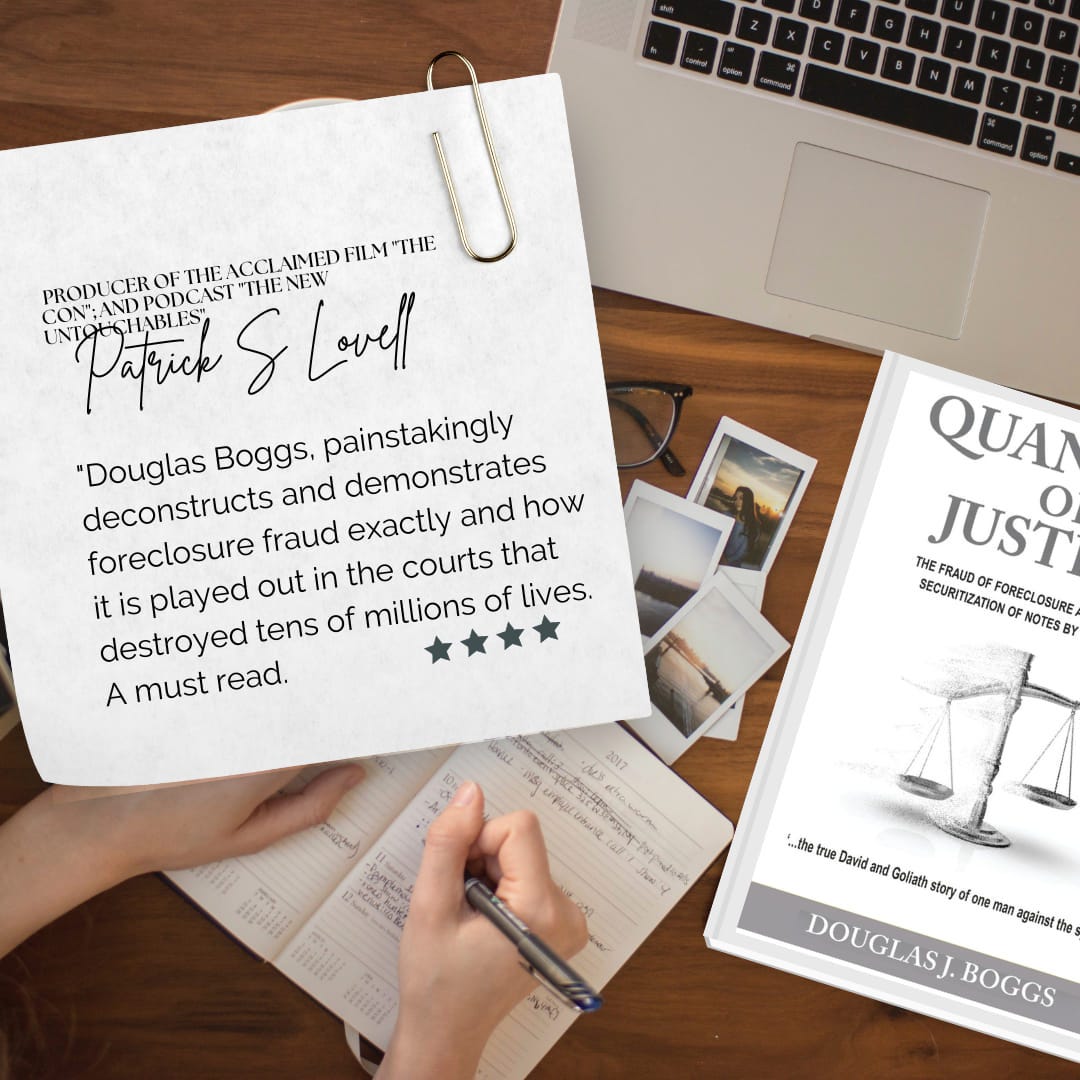

If you are interested in knowing more about my background, and see inside how I do my research, read my critically acclaimed book “Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street”.