In the ever-turbulent seas of financial markets, the specter of leverage has always hovered ominously—a precarious balancing act between growth and disaster. The recent Federal Reserve's Financial Stability Report serves as a stark reminder of the latent risks associated with excessive leverage, echoing the systemic follies laid bare during the financial cataclysm of 2008. It paints a vivid picture of hedge funds and life insurers teetering on the edge, propped up by the mighty, yet unstable, scaffolding of Wall Street's federally-insured megabanks.

The modern capitalist’s paradigm is wrought with a mirage of investment guarantees. These investment guarantees often paint a rosy picture for investors, appealing with the promise of assured returns and financial security. However, this assurance can morph into a double-edged sword when combined with excessive leverage, creating a facade of stability that masks underlying vulnerabilities. As illuminated in the critically acclaimed book “Quantum of Justice” by author Douglas J Boggs and echoed in Michael Lewis' book and Oscar winning film “The Big Short”, the allure of guarantees contributed to the creation of complex financial instruments, like mortgage-backed securities (MBS), that were misunderstood, misrated, and mismanaged, leading to the great unraveling in 2008.

Modern day capitalism has built in systemic overextension and high risk tolerance to its investment appetite. The core issue at hand is the systemic overextension of portfolios beyond their risk tolerances, a perilous journey fueled by optimism and greed. In the prelude to the 2008 crisis, financial institutions, driven by the voracious appetite of hedge funds and insurers for high-yielding assets, extended beyond prudent boundaries. They amassed mortgage-backed securities, believing they had diversified risk away through complex derivatives like collateralized debt obligations (CDOs). Yet, as time showed, these structures were perilously brittle, built on shaky credit foundations. Today’s concerns mirror yesterday’s missteps, with institutions again dancing perilously close to the fire of illiquid and risky investments.

With the Smoke and Mirrors of investment guarantees lies the fraudulent allure of security. The backdrop of 2008 spotlighted another grim reality—the fraud intertwined with guaranteed returns and engineered financial products. The insistence that MBS and related derivatives were safe investments, backed by rigorous technology and data, revealed itself as a great misrepresentation. Fraudulent ratings, motivated by revenue rather than reality, misled investors into a false sense of security. These missteps are reflected in today’s financial ecosystem, where continual overvaluation of derivatives and questionable lending practices may once again lure institutions into dangerous complacency.

As we transition into the crypto digital monetary platform will we move forward learning from the lessons from Wall Street's past? History’s lessons are stark. The collapse of Wall Street titans like Bear Stearns and AIG was not merely the result of poor judgment, but of a deeply embedded culture that failed to heed the peril of over-leveraging. As detailed in *The Big Short*, the chase for profit overshadowed the need for due diligence, leading to systemic risks that brought the global economy to its knees. This cautionary tale echoes in today's financial practices—of hedge funds leveraging to the hilt and insurers bearing portfolios riddled with alternative investments and opaque loans.

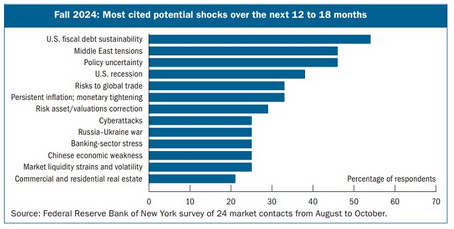

Still today there is systemic risk of the Fed’s ongoing opaque reassurances. Today, the Federal Reserve, amidst its reassurances of banking stability and resilience, must not forget these lessons. The persistence of “extend and pretend” loans, particularly in commercial real estate, poses a credible threat to perceived stability. The Fed's recent survey of economic concerns that failed to acknowledge potential political volatility exemplifies a broader reluctance to address the full scope of risk.

As investors we all should be asking for a call for vigilance and acknowledgment. Ripple’s XRP is the poster child of the crypto world that has become the most regulated digital asset on the planet. This should bring some sort of solace to the XRP investors as we move into the digital transition of the ISO 20022 standard beginning on January 1, 2025. As we stand at the precipice of a potential financial reckoning, the insights from past crises implore us to proceed with caution. The complexities of derivatives, the allure of leverage, and the promise of guaranteed returns harbor both opportunity and peril. A prudent financial system acknowledges this dichotomy, emphasizing transparency, accountability, and a reevaluation of risk tolerance.

Thus, as we navigate these turbulent waters, particularly those churned by the massive shoes of megabanks and the ambitions of hedge funds and insurers alike, we must remain vigilant. The echoes of history urge us to learn, adapt, and ensure that the promises of today do not become the pitfalls of tomorrow. For in the saga of finance, the lessons of the past must invariably guide the paths of the future, lest we repeat the dissonant chorus of financial folly.

The following details give a furthering in depth review to this issue and is reserved for the paying subscribers.

Keep reading with a 7-day free trial

Subscribe to SMOKE & MIRRORS... and the art of critical thinking to keep reading this post and get 7 days of free access to the full post archives.