XRP has just carved out a striking path, erupting past the $1.46 mark like a superstar breaking free from the confines of obscurity, all sparked by the shocking announcement of U.S. SEC Chair Gary Gensler's resignation. This monumental shift didn’t merely mark a moment in time; it set off a chain reaction of positivity swirling around XRP.

As the dust settled from Gensler’s departure, the data told a compelling story. Open interest surged a staggering 31.72%, catapulting to a record-breaking $2.42 billion, a significant leap from the $1.56 billion recorded just moments after XRP embarked on its latest ascension, as detailed by Coinglass. This surge isn’t just numbers on a screen; it illustrates a palpable shift in market sentiment.

The landscape of XRP holdings is transforming. Large wallets—those with over a million XRP—have amassed an impressive 453.3 million coins in the span of a week, revealing a confidence that resounds through the community. On the flip side, smaller holders, those clutching less than a million XRP, opted to part ways with 75.7 million coins during the same period. It’s a dance of accumulation and distribution, reflecting a broader narrative of market dynamics at play.

Adding another layer to this unfolding drama, XRP’s trading volume in South Korea surged to unprecedented heights, surpassing even that of Bitcoin. With trading volume hitting a staggering $2.29 billion on Upbit, South Korea’s largest crypto exchange, it eclipsed Bitcoin’s volume of $798.82 million. This is not merely market activity; it’s an indication that XRP is capturing the spotlight in a fierce and competitive arena, rising to the occasion and captivating the attention of traders far and wide.

Let’s turn our attention to China. Remember that the government of China has been a Ripple partner since 2013. Brad Garlinghouse understands the impact that the Chinese market will have on XRP and the crypto ecosystem once the Chinese population begin investing in crypto assets. China has the largest and fastest growing middle class in the world. China also holds the most billionaire class per capita in the world.

In a notable turn of events, a Shanghai court has stepped forward to affirm that owning digital assets, including the much-debated Bitcoin, is indeed legal under Chinese law. This clarification came from none other than Judge Sun Jie of the Shanghai Songjiang People's Court, who took to WeChat to relay this critical message via the Shanghai High People's Court channel.

Judge Sun underscored a crucial distinction: while Chinese citizens are free to hold cryptocurrencies, businesses find themselves shackled by regulatory constraints. Enterprises cannot engage in cryptocurrency investments or initiate token offerings without navigating the maze of regulations that govern such activities.

This interpretation arose during the court's examination of a legal conflict between two companies over an initial coin offering (ICO), an act deemed illegal under the current Chinese legal framework due to its classification as unlawful fundraising. The backdrop of these proceedings reflects a government on guard; China has maintained a wary stance toward cryptocurrencies, fearing their potential to disrupt the stability of its financial systems.

In a sweeping gesture last year, the nation banned ICOs and cryptocurrency exchanges and escalated its crackdown further by forbidding Bitcoin mining and outlawing all business activities related to crypto in 2021. The dichotomy of China’s position on cryptocurrency ownership is striking, especially as the world around it marches onward, embracing its own trends in digital currency.

In his communications, Judge Sun categorized cryptocurrencies under Chinese law as a class of virtual commodities imbued with property-like characteristics. This classification allows individuals the legal right to own these assets, reinforcing an underlying principle of personal property rights.

Nevertheless, this perspective operates within the larger context of China’s objective to safeguard its financial systems from shadowy monetary activities, particularly those linked to the burgeoning realm of digital currency. However, the landscape remains complex and fraught with contradictions, as recently evidenced by the case of Yao Qian, a former director of the People's Bank of China's digital currency research institute. Reports indicate that Qian was ousted after an investigation revealed his acceptance of substantial crypto sums in exchange for political favors. This incident lays bare the tensions and inconsistencies inherent in China's regulatory framework—one that Qian once helped navigate.

Despite this recent clarification on ownership, it is a truth known quietly among industry insiders that individual possession of cryptocurrencies has been, shall we say, informally tolerated. In fact, a number of Chinese courts have already ruled that digital assets can indeed be recognized as property, suggesting that in the shadows of regulation, the acceptance of crypto ownership has taken root, even as the government navigates its complex relationship with digital finance.

I will follow up soon with a post on the impact of what both China and India will have on XRP and cryptocurrencies. The United States government embrace of XRP happened years ago behind the scenes. Allthewhile, the SEC has been holding back the growth of XRP in the United States. And we hear yesterday from Gary Gensler, SEC Chair, that he will be stepping down on Jan 20, 2025, just prior to the new administration taking the helm. Like I have been saying, he is the “Ollie North” of today.

I feel that all of the legal wrangling with the SEC has been a smoke screen for the whales and large institutional players to be able to secure their positions without causing a buying frenzy as the global digital transition takes its root beginning on January 1, 2025. It is then that the ISO 20022 Standard will begin at the institutional level across the globe with XRP as the main blockchain platform for all institutional cross border payments. I believe that China and India are playing that same game. As China now opens up we will see exponential growth of the crypto sector with India still holding in the wings.

In a landscape rife with uncertainty, XRP stands tall—a testament to resilience and potential, propelling forward in the wake of change.

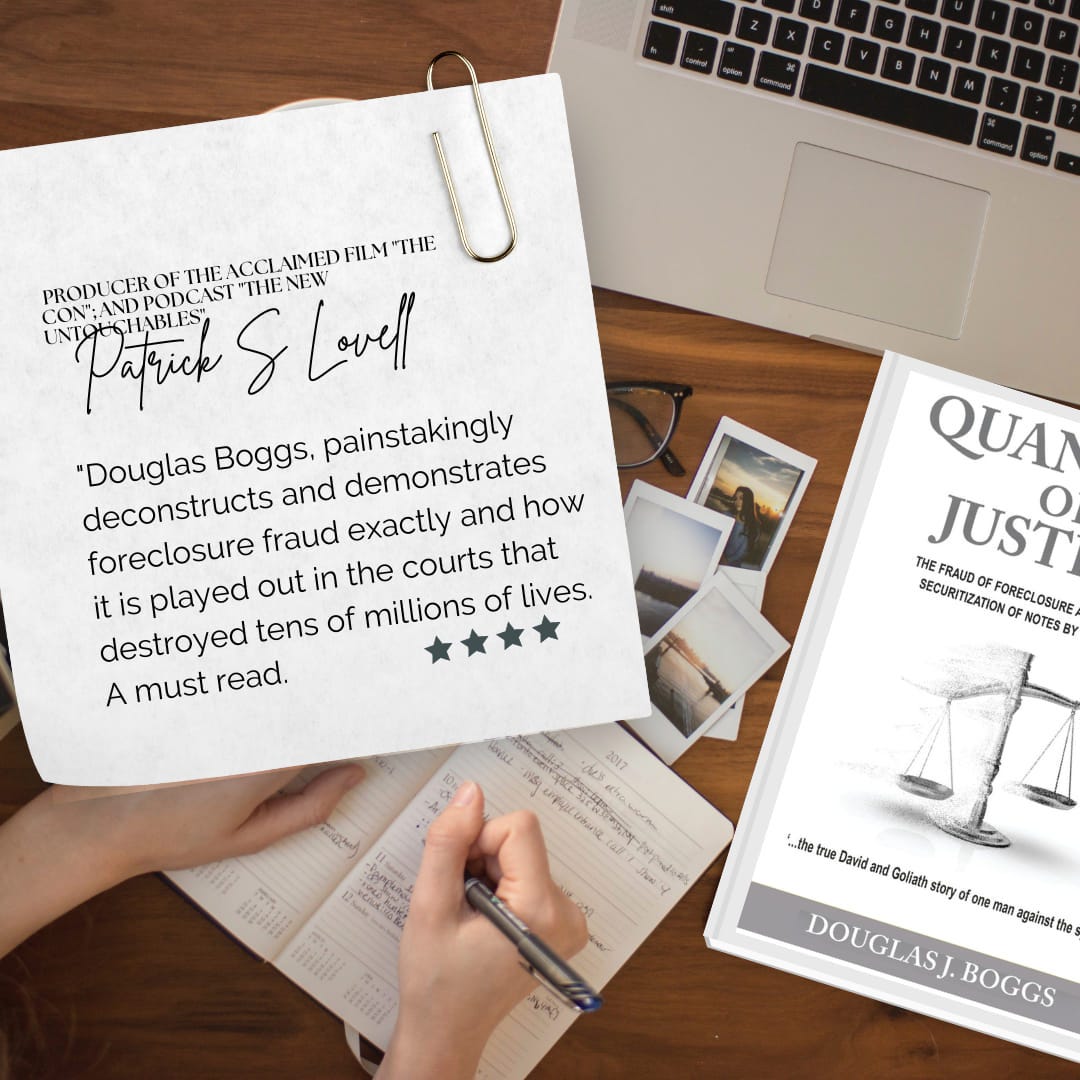

If you are interested in knowing more about my background and how I do my research you might purchase and read my critically acclaimed book “Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street”.