One thing I learned while we were recently sailing through the British Virgin Islands was the ole sailing phrase “Stay the course.”

In my most recent post of “XRP News” I discussed the institutional whale accounts getting into the active trading market. Many of them have awakened from a long slumber due to the long lawsuit that the SEC held against Ripple. Now that many high levelers at the SEC have apologized to Ripple, and Chairman Gary Gensler has announced he is stepping down, there has been an onslaught of new blockchain accounts of major XRP holders waking and becoming activated.

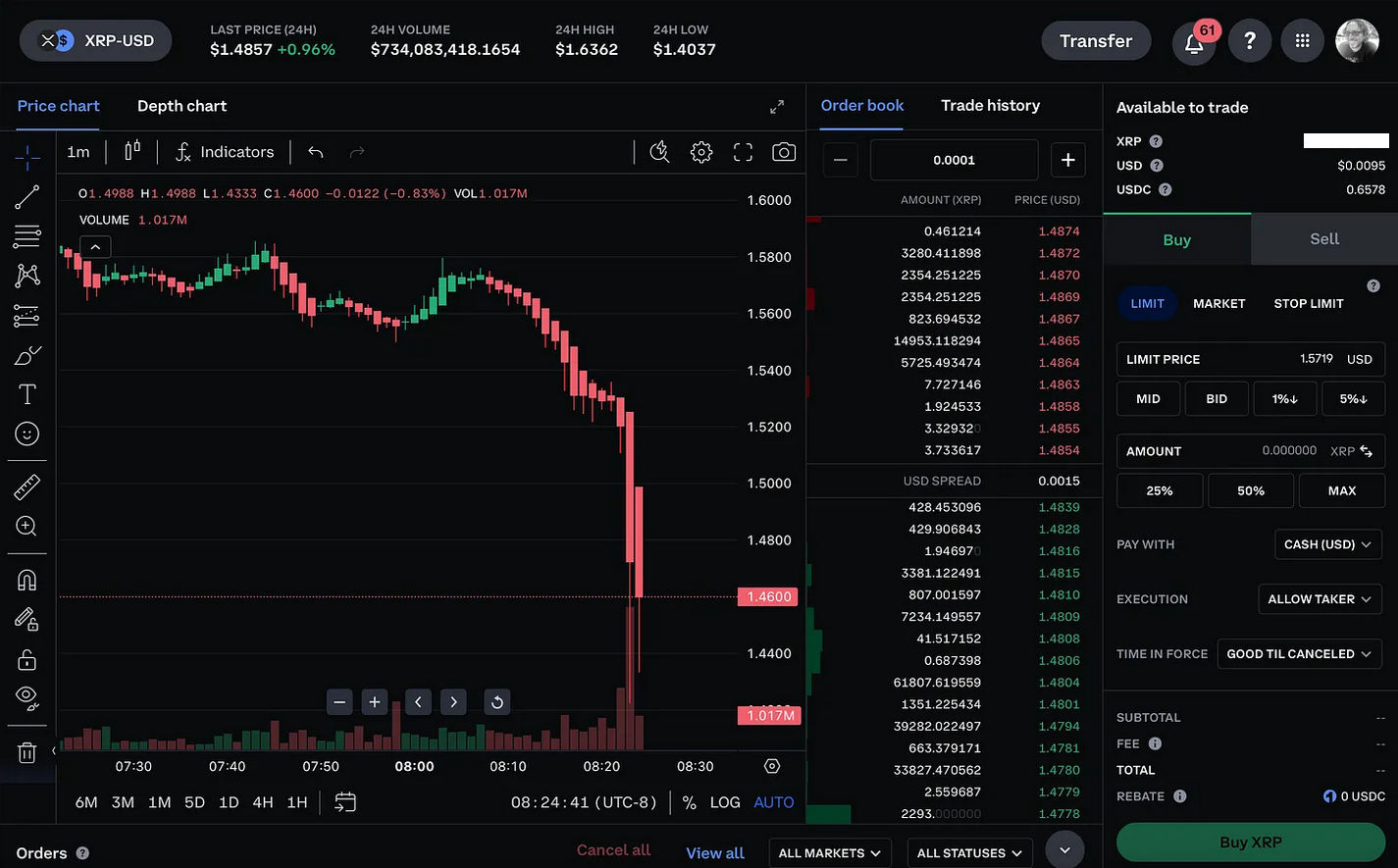

We can see from this chart the higher volume of weekend trading. Based on the Trade history charts we would find that there are whales taking some profit from the extraordinary week that XRP has had. They will then turn back into the game and buy on the low. This is what is referred to in the trading world called “dollar cost averaging”. The is also a historial pattern of profit taking over the weekend. Remember, crypto is online 24/7 with no holidays or trading downtime. A bit different process than Wall Street.

Now keep in mind that the China market has just begun to open, as based on this week’s legal decision from a Shanghai Judge. We will begin to see the “weekend” trading patterns become shorter due to the international timeline.

In my opinion, as a long XRP holder, this crypto asset that sits in your bags is for the long haul. In its blockchain design, its global contracts with Central and international institutional banks XRP is positioned to be the global means of moving money across borders across the planet.

So, there will be ebbs and flows. This is only a concern if you are doing day trading or perhaps wanting to do some dollar cost averaging. Otherwise, you just need to sit back and relax and slowly watch your investment grow over time.

Just stay the course.

If you are interested in knowing more about my background and how I do my research you might purchase and read my critically acclaimed book “Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street”.