What's so special about Decentralized Digital Assets and ISO 20022 Compliant Cryptocurrencies?

Why should you care?

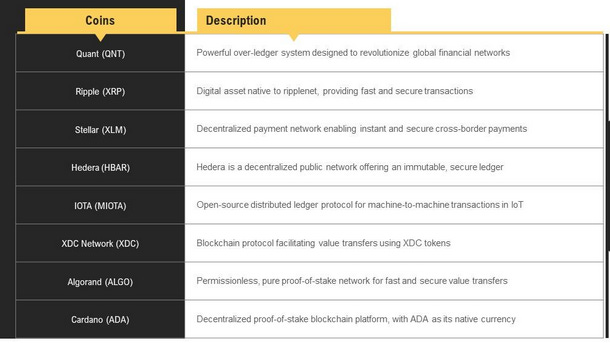

In recent years, decentralized digital assets have surged in prominence, offering transformative potential for how financial transactions are conducted across the globe. Among these assets, cryptocurrencies such as XRP, XLM, XDC, HBAR, QNT, ALGO, ADA, and IOTA stand out, not just for their innovative technologies but also for their compliance with the ISO 20022 standard, an international protocol for electronic data interchange between financial institutions. This standard is pivotal for ensuring interoperability, enhancing communication across financial networks worldwide, and facilitating seamless cross-border transactions.

These digital assets are increasingly significant in both institutional and consumer contexts. Institutions are drawn to their potential for reducing transaction costs, increasing transparency, and improving speed and efficiency in settling payments. For consumers, these assets offer the promise of more accessible, equitable financial services, especially in regions where traditional banking infrastructure is lacking. They empower individuals with greater control over their financial transactions, aligning with the original spirit of decentralization that breaks away from the conventional fiat currency paradigm dominated by centralized authorities.

What is the systemic importance of regulation in the decentralized ecosystem? Despite the decentralized ethos underpinning these digital assets, regulation is becoming an increasingly vital consideration within the cryptocurrency ecosystem. The initial appeal of cryptocurrencies lay in their ability to operate outside traditional financial systems, offering privacy and freedom from centralized control. However, as these assets have gained institutional acceptance and broader adoption, the need for regulatory oversight has become apparent for several reasons:

1. Consumer Protection: In an unregulated environment, consumers are more vulnerable to scams, fraud, and hacking incidents. Regulation helps to establish safeguards that protect consumers and enhance trust in the ecosystem.

2. Market Stability: Regulatory measures can mitigate the extreme volatility often associated with crypto markets, promoting stability which is crucial for attracting long-term institutional investment and integration into mainstream finance.

3. Preventing Illicit Activities: Without regulation, cryptocurrencies can be misused for money laundering, tax evasion, and other illegal activities. Regulatory frameworks help law enforcement agencies monitor and prevent such abuses.

4. Interoperability and Standardization: Compliance with standards like ISO 20022 not only ensures compatibility across different financial systems but also aligns with regulatory requirements, facilitating smoother integration with traditional financial institutions.

5. Fostering Innovation: By providing clear guidelines, regulation can create an environment where innovation can thrive safely. It reassures businesses and developers, allowing them to focus on improving technologies and expanding use cases.

As the decentralized finance landscape continues to evolve, balancing the promise of decentralization with the necessity of regulation will be crucial. Appropriate regulatory measures can help maintain the integrity of the crypto ecosystem, ensuring it fulfills its potential to revolutionize the way both institutions and consumers engage with finance while upholding the principles of security, transparency, and accountability.

I welcome the readers to help explore the community by answering a few questions:

The following details gives the reader a furthering in depth review to this issue and is reserved for the paying subscribers.

Keep reading with a 7-day free trial

Subscribe to SMOKE & MIRRORS... and the art of critical thinking to keep reading this post and get 7 days of free access to the full post archives.